Whoa! This article starts in the middle of a thought because that's how most of my best decisions happen — half gut, half spreadsheet. I'm biased, but multisig felt like overkill at first. My instinct said "keep it simple," and then reality bit: single-key wallets are a single point of failure. Initially I thought multisig would be clunky and brittle, but then I actually used it for months and learned the chores that matter versus the theater.

Seriously? Yes. Multisig is the practical upgrade from a hot wallet that trusts too much. For experienced users who want lightweight, fast desktop flows, multisig trades tiny amounts of convenience for a huge security boost. On one hand you get redundancy and shared control; on the other hand you accept coordination overhead and slightly more setup friction. Though actually, once you standardize a workflow — like a read-only mobile watch-only instance plus two hardware keystores — life gets easier, not harder.

Hmm... here’s the shorthand: multisig means multiple private keys must sign a transaction. It’s not magic. It’s math and deliberate failure-mode planning. You can do 2-of-3 for a personal setup (phone, hardware, desktop), or 3-of-5 for a small org. Each choice has tradeoffs in recovery complexity and daily convenience. The right balance depends on your threat model and how often you move funds.

Check this out—I've landed on a pattern I use daily. Short explanation first. Then a longer dig into the hows and whys, with a few caveats. The goal: a nimble desktop wallet that talks cleanly to hardware keys and remains user-responsible.

Whoa! Desktop wallets still win for power users. They give you local files, flexible backups, and decent hardware integration without being shoehorned into mobile app sandboxes. Electrum is lean, script-aware, and friendly to advanced users — and yes, I linked to it because it’s what I use: electrum wallet. That single choice supports multisig natively, lets you export PSBTs, and plays nicely with hardware like Trezor, Ledger, and coldcards.

Here's the nuance: Electrum's UI can feel old-school. It expects users to understand seed formats, xpubs, and PSBT workflows. But it's honest. It surfaces the pieces you need to trust. Initially I thought the lack of UX glitter was a downside, but then I appreciated the clarity—no black boxes. On balance, for a desktop-based multisig, Electrum hits the sweet spot between transparency and capability.

Tip: use a dedicated machine or VM for cosigner duties if you can. It doesn't have to be isolated to the point of paranoia, but segregating signing keys reduces risk dramatically. (oh, and by the way...) keep your wallet files on encrypted disk. Seriously, small steps add up.

Whoa! Workflow matters more than the exact configuration. A 2-of-3 scheme is my default for individuals. Two physical hardware devices plus a desktop-based offline signer makes daily ops smooth and recovery realistic. Two cosigners online and one offline is another practical layout for folks who move money frequently; you get speed without giving away every key to an internet-facing machine.

First, create a deterministic descriptor or seed on each hardware device and store xpubs in one master Electrum file. Second, keep one cosigner as cold as your patience allows — a laptop locked in a safe, or an air-gapped machine that only speaks PSBTs via USB stick. Third, test recovery. Build a test wallet and simulate a loss. You'll be surprised how somethin' as simple as a mis-typed label can derail a restore if you haven't practiced. Practice matters.

On the practical side, PSBT is your friend. Export the PSBT from the online Electrum instance, import that on a hardware signer (or cold Electrum), sign, and then broadcast. It's a few more steps than single-sig, but you avoid trusting a single signer. That small discipline stops many frauds in their tracks.

Whoa! Hardware wallets are not all created equal for multisig. Some devices export xpubs cleanly and support descriptor derivation, while others require more manual wrangling. My advice: pick hardware that plays well with Electrum and update firmware cautiously. I'm not 100% sold on auto-updates; manual control is my jam.

On one hand you want automation. On the other hand automation can hide assumptions that cost you later. For instance, watch out for devices that change derivation defaults across firmware versions — that can create non-obvious incompatibilities. Keep explicit notes of derivation paths and use mnemonics only as a last resort during restores. Also keep a compact, labeled pad with xpub strings in a secure location — not the private keys, just the public details you need for recovery.

Also: the UX for cosigner coordination can feel a bit like horse trading if you don't standardize a flow. Agree on file names, PSBT transport method, and signature order before you need them. This is tedious, but it's also the difference between a smooth emergency and a frantic scramble.

Whoa! Threat modeling is boring but vital. If you're protecting a life-changing stash, assume state-level actors will try. If you're protecting a few bitcoin for trading, assume targeted scams and device theft. The multisig goals change accordingly. 2-of-3 with geographically-distributed cosigners protects well against theft and device failure. 3-of-5 with institutional oversight protects against insider risk.

I'm going to be blunt: multisig is not a cure-all. You still need physical security, social engineering awareness, and good operational hygiene. On the flip side, multisig removes the single point of total failure that many users ignore until it's too late. My honest view is that multisig gives you durable resilience at a modest long-term cognitive cost.

One more thing—watch-only setups are underrated. Keep a watch-only Electrum instance on your phone to monitor balances without exposing signing keys. This gives situational awareness so you can react quickly if something odd appears.

A: Not terrible. Expect an hour the first time if you include hardware device initialization and testing. Follow a checklist: create seeds, export xpubs, assemble the multisig wallet in Electrum, test PSBT signing, and practice recovery. Do it slowly. Do it twice.

A: Yes, you can mix brands. That diversity improves security by reducing single-vendor failure modes. But verify firmware compatibility and descriptor formats. Test signing across devices before moving large sums.

A: Backup xpubs and descriptor info to secure, separate places. Back up at the cosigner level, not the private keys if possible. Most importantly, rehearse a restore on a spare device so you know the steps fluently—practice makes recovery work under pressure.

Okay, so check this out—I've been fiddling with cold storage for years. Wow! I keep coming back to one idea: if you really own crypto, you need a device that proves that ownership without trusting a stranger. My instinct said the same thing years ago, and that gut feeling has held up under real-world use and a fair number of screwups. Initially I thought all hardware wallets were basically the same, but then reality—slow, annoying, and educational—taught me otherwise.

Short answer? Hardware wallets reduce attack surface. Longer answer? They force attackers to beat a physical device, not just a password stored on a cloud server. On one hand that's comforting. On the other hand, it creates new failure modes: lost devices, busted seeds, or user mistakes during setup. I'm biased, sure—I've lost a seed phrase once (don’t do that)—but that experience drilled in why the UI, documentation, and recovery process matter as much as the chip inside.

Really?

Here's the thing. A hardware wallet is a tiny fortress you carry in your pocket. It signs transactions offline. It isolates private keys from the internet. That sounds simple, but the devil lives in the details. The microcontroller, secure element choices, open-source firmware, and recovery options all change the security profile. When a wallet is open-source, you can audit or at least read what it's doing. That transparency matters to the crowd that values verifiability—like many folks reading this.

Hmm... I remember my first Trezor. Small box. Clean packaging. It felt reassuringly basic—no flashy extras. The screen was modest. The buttons felt solid. It wasn't trying to be a Swiss army knife. That was deliberate. But let me rephrase: minimalism is a feature, not a limitation.

On paper, a closed-source device can claim fancy features. In practice, a community that can audit firmware and tools will find issues faster. I watched that happen. There was a small bug that the community flagged quickly because the code was public. The vendor fixed it. That's how trust compounds.

Okay, so check this out—if you value verifiability, then a device whose firmware you can inspect (or that a community inspects) reduces the asymmetric risk between you and the manufacturer. You don't have to take their word for it. You can at least peek. If you're the sort of person who likes to tinker, or who wants to ensure there’s no stealthy telemetry, open tools let you sleep better. I'm not 100% sure that every user will audit code, but the option matters.

My instinct said simplicity would win. And it mostly has. But there are trade-offs. Some users want extra features like battery backup, screens big enough for fancy QR codes, or Bluetooth. Those features expand attack surface. So, trade-off analysis is key. Initially I resisted Bluetooth for hardware wallets; later I accepted that in certain controlled environments it could be useful—though actually, wait—let me rephrase that: convenience often comes at a cost, and that cost must be weighed.

On the practical side, here are the parts that matter most in real use: sturdy seed backup, recoverable passphrase options, a screen you can trust, and a vendor community that answers questions without vague corporate speak. Also, plastic cases break, cords fray, and people forget PINs. Those are human problems, not silicon problems.

Seriously?

Let me walk through a typical setup (without giving step-by-step attack blueprints, obviously). First impression: is the packaging sealed and untampered? Then: does the device generate your seed locally? Good. Do you write it down on a physical medium and store it somewhere safe? Good. Do you test the recovery process on a spare device or emulator? Very very important. I recommend practicing once early, when stakes are low. That practice is where confidence is built—or where somethin' goes wrong and you learn fast.

On one hand a hardware wallet prevents remote malware from signing transactions. On the other, if you mis-handle the recovery phrase, or use a poor backup, a physical device won't save you. I learned that the hard way: a friend of mine stored his seed phrase in a cloud note (no kidding), and after a phishing attack his account and holdings were drained. You need to treat the seed like cash tucked into a safe—not like a social media password.

trezor has built a reputation on openness and sensible defaults. Their firmware is open-source, the design choices are conservative, and the user workflow nudges people toward safer practices. If you like being able to see what's going on under the hood, Trezor gives that path. I like that. I'm biased toward open projects because I've seen closed systems hide poor choices.

That said, no vendor is perfect. The community catches things rapidly with open-source projects, but vendors must be responsive. Sometimes updates introduce UX friction—like asking you to re-enter a seed for a firmware upgrade—and that frustrates people. That friction, though, is often a safety net. It forces a re-check.

Here’s what bugs me about wallets that try to be everything: they become confusing. People pick defaults without understanding them. They enable cloud backups for convenience and then wonder why they were hacked. So my pragmatic advice: choose a reliable device, learn its simple safe patterns, and accept the mild inconvenience of doing a recovery test.

Whoa!

And tangents—(oh, and by the way...)—if you're in the U.S., consider where you'll store physical backups. A safe deposit box is fine, but make sure the institution's hours and policies align with your needs. Also, local metaphors: think of the seed phrase like the keys to a cabin upstate—you wouldn't leave those keys taped to the front door, right?

All right. For advanced users, there are layered protections: use a hardware wallet plus a passphrase (sometimes called a 25th word). That raises the security bar substantially, but it also raises recovery complexity. Initially I thought passphrases were overkill for average users, but after evaluating threat models (like targeted theft or extortion), they make sense in certain contexts. On the flip side, losing the passphrase can be catastrophic. So, on one hand you gain secrecy, and on the other you increase the chance of permanent loss if you're sloppy.

Hmm... I'm not perfect. I once tried to explain passphrases to a group and used a terrible analogy. People nodded politely. I learned to simplify: passphrase = additional secret key that never touches the device storage. That clicked.

Look at openness, community support, and your own comfort with the recovery process. If verifiability is crucial, favor open-source projects or ones with audited firmware. Also check that the device supports your coins and your preferred software stack. Try to buy from an authorized reseller and verify packaging. Practice a recovery on a spare device or recovery emulator before moving large funds.

If you've backed up the seed correctly, you can recover funds on a replacement device. Practice that recovery before you need it. If you used a passphrase and lost it, recovery may be impossible. So store passphrases as carefully as the seed—if you use them at all.

No. They greatly reduce attack vectors, especially remote ones, but they are not magic. Social engineering, poor backup practices, physical coercion, or buying a tampered device from a shady seller are all risks. Defense in depth is your friend: strong operational security, trusted device supply chain, and conservative settings.

To wrap up my messy, human take: if you want custody and verifiability, pick a hardware wallet you can trust, learn it, and test recovery early. Things will feel awkward at first. That's normal. Over time it becomes routine, and then you can sleep easier knowing your keys are truly yours. I'm leaving with a different emotion than I started—less anxious and more pragmatic—though still a bit skeptical of flashy convenience features. Somethin' about the basics just sits right with me.

Read moreWhoa! Okay, so here's the thing. If you manage cash for a mid-size company or run treasury for a large enterprise, the way you log into and use Citi's corporate portals can make or break a day. My instinct said this was simple at first. But then I watched three different teams stumble over the same issues in one month, and something felt off about the whole onboarding process.

I'm biased, but I prefer practical steps over corporate-speak. Initially I thought most problems were technical. Actually, wait—let me rephrase that: a lot of them are human problems wrapped in technical packaging. On one hand you have complicated security requirements; on the other, you have people who want to get paid and keep suppliers happy. Though actually, those two aims can live together if you set up the right controls early on.

Here's a quick roadmap of what we'll cover: deciding whether to use Citi's corporate portals, how to approach the citidirect login safely, admin best practices, and the policy/tech mix that keeps things humming. I'll share some tangents and a couple of real-ish anecdotes (names changed, details fuzzy) because those are the things that stick.

Really? Yes. Because most cash problems come from delays, missing approvals, or people using the wrong account. A solid online banking setup reduces friction. It also centralizes audit trails, which your auditor will love and your CFO will pretend to love (but they do).

Fast fact: corporate portals like CitiDirect give you permissions granularity that consumer interfaces don't. That matters when you have decentalized teams doing global payments. My instinct said prioritize role-based access early. It saved us hours later when someone left and we had to revoke privileges.

Okay, so check this out—before anything else, confirm the URL and the communications you receive. Fraudsters love to spoof big-bank pages. If you or your team are ever unsure, call your Citi relationship manager (preferably from a number on file).

When you use the citidirect login, do it from a company-managed machine whenever possible. Enable multi-factor authentication. Use hardware tokens for high-value users if your bank supports them. These are straightforward moves but they save a lot of heartache.

Something I tell teams: bookmark the approved login page and teach everyone to use the bookmark. It's simple, but it prevents the "I clicked that email" mishaps that happen at 2 a.m. (true story — we once had a vendor payment almost sent to the wrong bank because someone clicked a suspicious link). Somethin' to watch for.

Short version: be stingy with admin rights. Medium version: create clear role definitions (maker, checker, approver, auditor) and map them to real people. Longer thought: build a cadence for reviewing permissions quarterly, and tie it to HR offboarding so access is revoked automatically when someone leaves, which should be scary obvious but often isn't.

Onboarding should be scripted. Have a checklist. Seriously. Include items like: identity verification completed, MFA set up, training session scheduled, and transactional limits applied. Initially I thought a 30-minute walkthrough was enough. But repeated mistakes taught me that a recorded session plus a short quiz (yep, a quiz) reduces errors by a surprising margin.

Also: avoid shared accounts. They make audits painful. If multiple people need to execute similar tasks, give them individualized access and use group templates for approvals so the workflow remains efficient.

We'll keep this quick. Use MFA. Use strong device management. Monitor for unusual activity and set up alerts on high-value transfers. And yes, do the things your compliance team nags you about — daily reconciliation, positive pay, dual controls.

On one hand, there are tech controls. On the other hand, there are human controls — training, prank-proof procedures, and a culture that encourages reporting suspicious emails. Though actually, the hardest part is changing habits. People will try to bypass multi-step approvals if the process is slow. So optimize the workflow before tightening the screws too much.

Integration matters because manual entry equals error. If your ERP can connect to CitiDirect (or any corporate portal), automate bulk payments and receipts where safe. But don't automate blind. Start with low-value batches and run reconciliation checks in parallel.

Pro tip: use a sandbox environment first. It's much cheaper to find the bugs there than in production. My team once pushed a mapping error into production — very very awkward. We caught increased reconciliation mismatches and fixed it, but the scare was real.

Here are the typical culprits, short and sweet:

If something looks off — a payment you didn't authorize or a change you didn't request — pause. Really pause. Contact Citi through the phone number you have on file. Do not call a number in an email unless you've confirmed it's correct.

Here's a quick list you can run through in under five minutes:

Okay. Something bugs me about over-reliance on self-service. It's great until it's not. If you hit regulatory or fraud issues, escalate to your bank and internal legal/compliance right away. Keep a playbook for incident response and rehearse it annually. Rehearse; don't assume you'll figure it out under pressure.

Initially I thought we could rely on email trails alone. Now I know better. Use system logs, export them, and retain them in a secure location. You'll thank yourself during audits.

And yes, keep the relationship manager in the loop. They're not just salespeople; they can expedite ticketing and validate suspicious communications faster than anonymous support channels sometimes can.

Always validate the domain and the SSL certificate, and use contact numbers from your internal file. Bookmark the approved login and train users to use that bookmark rather than clicking emails. If in doubt, call the bank directly.

Follow your bank's identity verification steps. Have a secondary method pre-registered. In high-risk scenarios, temporarily restrict privileges until the user is re-verified.

Yes. Start with sandbox testing, map fields carefully, and run dual reconciliation until you trust the automation. Automate cautiously — it's powerful, but not infallible.

I'll be honest: corporate banking access isn't glamorous. But when it's set up right, it removes friction and risk in equal measure. Keep the citidirect login habits simple, secure, and well-documented. And if something feels weird, trust that gut — then verify. Really fast.

For more specifics on the login process and a reference page I use during onboarding, see citidirect login.

Read moreЗаказ шлюхи для длительных встреч может быть захватывающим опытом, но также может принести разочарование, если не будут соблюдены определенные условия. В данной статье мы рассмотрим ключевые моменты, которые помогут вам избежать разочарований и сделать ваше время с шлюхой незабываемым.

Первым шагом к успешной встрече с шлюхой является правильный выбор агентства. Обратите внимание на отзывы клиентов, репутацию компании, а также наличие лицензии на предоставление услуг. Надежное агентство гарантирует вам безопасность и качество услуг.

Прежде чем заказать шлюху, уточните все детали встречи: продолжительность, услуги, возможности. Убедитесь, что условия предоставления услуг и расценки четко прописаны, чтобы избежать недоразумений в процессе встречи.

Важно выбирать агентства, которые гарантируют полную конфиденциальность ваших данных и уважение вашей частной жизни. Доверие между клиентом и агентством является основой успешного сотрудничества и предотвращает разочарования.

Прежде чем встретиться с шлюхой, не забывайте об общении. Уточните все детали встречи, ваши предпочтения, а также ожидания от встречи. Чем больше информации вы обмениваетесь перед встречей, тем выше вероятность успешного и приятного времяпрепровождения.

Помните, что шлюха также является человеком. Уважайте ее личное пространство, границы и чувства. Сделайте все возможное, чтобы создать дружественную и комфортную атмосферу во время встречи.

Попробуйте быть открытыми к новым впечатлениям и сюрпризам во время встречи. Не бойтесь выразить свои желания и фантазии - это поможет сделать ваше время с шлюхой незабываемым и приятным

После встречи с шлюхой не забывайте дать обратную связь агентству. Расскажите о своем опыте, что вам понравилось, а что можно улучшить. Обратная связь поможет другим клиентам выбирать надежные агентства и повысит качество услуг.

Если встреча с шлюхой вас удовлетворила, не стесняйтесь планировать следующую встречу. Хорошие отношения с агентством и шлюхой обеспечат вам доступ к высококачественным услугам и приятным встречам в будущем.

Заключение:

Избегайте разочарований при заказе шлюхи, следуя рекомендациям данной статьи. Помните о важности выбора надежного агентства, общении с шлюхой перед встречей, уважении и открытости. Соблюдайте принципы конфиденциальности и обратной связи, и ваше время с шлюхой станет незабываемым и приятным.

Read moreOkay, so check this out—I've used a lot of wallets. Wow! I mean, really, a lot. At first glance they all felt the same; sleek UIs, bold claims, and somethin' missing under the hood.

My instinct said "go simple" but my habits pulled me back toward power tools. Hmm... Initially I thought a single device would solve everything, but then realized cross-device sync and flexible key management matter more than I expected. On one hand convenience wins, though actually, on the other hand, safety and control win bigger when you hold your keys. That tug-of-war is why a multi-platform, non-custodial wallet makes sense for many of us in the US crypto scene.

Here's the thing. Multi-platform doesn't just mean "apps for desktop and phone." It means continuity — sending a transaction on lunch break from your phone and finishing it at night on your laptop without relearning your setup. Seriously? Yes. That continuity cuts friction, which is the real adoption barrier for normal people who aren't crypto nerds.

Guarda strikes that balance in ways that felt natural to me, not forced. My first impression: clean. Then I dug in more—key backup options, seed management, and the option to remain truly non-custodial without sacrificing features. I tried the extension, the mobile app, and the desktop app over several weeks, and the ecosystem felt cohesive rather than bolted together.

I moved funds between chains during a market blip and intentionally tested edge cases—token approvals, low-fee windows, and a partially applied swap. Whoa! The recovery phrases worked; the apps respected them. One odd moment: I exported a JSON file and then reimported it to another device and got a tiny mismatch in accounts order. Nothing catastrophic, but it flagged that I should document my own labeling process.

Okay, so yes, I had to re-learn a tiny bit. That's human. Actually, wait—let me rephrase that: the experience rewarded patience. There were more advanced options than I used at first, which is a good problem to have for power users. But casual users will find sensible defaults, too.

What bugs me about many wallets is the "one-size-fits-none" approach. Guarda felt different. It offered both simple send/receive flows and deeper controls for custom gas, token management, and hardware-wallet pairing. My bias is leaning toward wallets that don't hide complexity by removing choice; Guarda kept the choices accessible without being loud about it.

Here’s a concrete bit: I paired a hardware device, approved an ERC-20 approval, and then canceled a pending tx when gas spiked. It wasn't magic, but it worked reliably across the extension and the desktop app. That cross-platform behavior reduced my cognitive load. Hmm... I like that.

Security-wise, non-custodial means you control keys. That also means you're responsible—no one else will bail you out if your seed phrase gets lost. My instinct said "store the seed offline," so I did; I used both an encrypted vault and a paper backup in separate locations. Nothing glamorous. Just practical. You should do something similar.

On the privacy side, the apps don't require invasive KYC just to use core functionality. That matters to many people, including me. Still, regulatory friction is a real thing and can make some features change over time—so keep an eye on updates. I'm not 100% sure which features will shift next year, but that's a shared industry reality, not a single project's flaw.

Cost and integrations also matter. Guarda includes buy/swap options and supports many chains. That convenience can be a double-edged sword: it reduces steps but can encourage quick moves without full thought. I had to slow down a few times—and that discipline saved me from a sloppy trade during a high-fee moment.

For developers and advanced users, the wallet's token import and custom RPC settings were handy. I added a testnet and an alternate chain in under a minute. The UI didn't scream "developer mode only"; instead, it made pro features available in a considered layout. That approach helps newcomers graduate into power users without the usual intimidation.

One small nit: some labels feel slightly inconsistent across platforms—double words here and there, and an occasional trailing tooltip that didn't fully explain an option. Not the end of the world, but it's the kind of small polish that, if fixed, would make the whole product feel even more professional. Also, I left a note to myself in the app notes field and later found I had typed "todo" twice—very very human.

When recommending a wallet to friends who are not obsessed with gas fees or chain fragmentation, I usually say: if you want true control and still want convenience, look at a multi-platform non-custodial option. For me, that included trying out and trusting Guarda in day-to-day flows. If you want to grab it and test it yourself, check the official download and info at guarda wallet.

I'll be honest: no wallet is perfect. There are trade-offs. On one hand, pure custody services add ease; on the other hand, they take control from you. I prefer control, but I'm biased. My friends who've prioritized set-and-forget convenience chose custodial solutions and are happy—different needs, different answers.

There were a few moments of genuine "aha" during my testing—like when a recovered account kept its token metadata and I didn't have to re-scan everything. That small convenience saved time, and time is underrated. On the flip side, a UI quirk once made me double-check the recipient address; that extra pause is fine. It kept me safe.

If you're new, here's practical advice from someone who's gone through setups: write your seed phrase down twice, keep one copy offline, test a small transfer first, and then scale up. Don't trust screenshots of seeds. Seriously? Yes—don't do that. And store passwords in a reputable manager.

Yes—based on typical non-custodial definitions, Guarda lets you manage your private keys and seed phrases locally. That means you keep control, and you also accept responsibility for backups and key safety.

Generally yes. The multi-platform design supports desktop, mobile, and browser extensions, enabling you to access the same seed on multiple clients. Initially I thought syncing would be automatic, but then realized manual import/export of seeds is sometimes necessary for deliberate, secure setups—so plan accordingly.

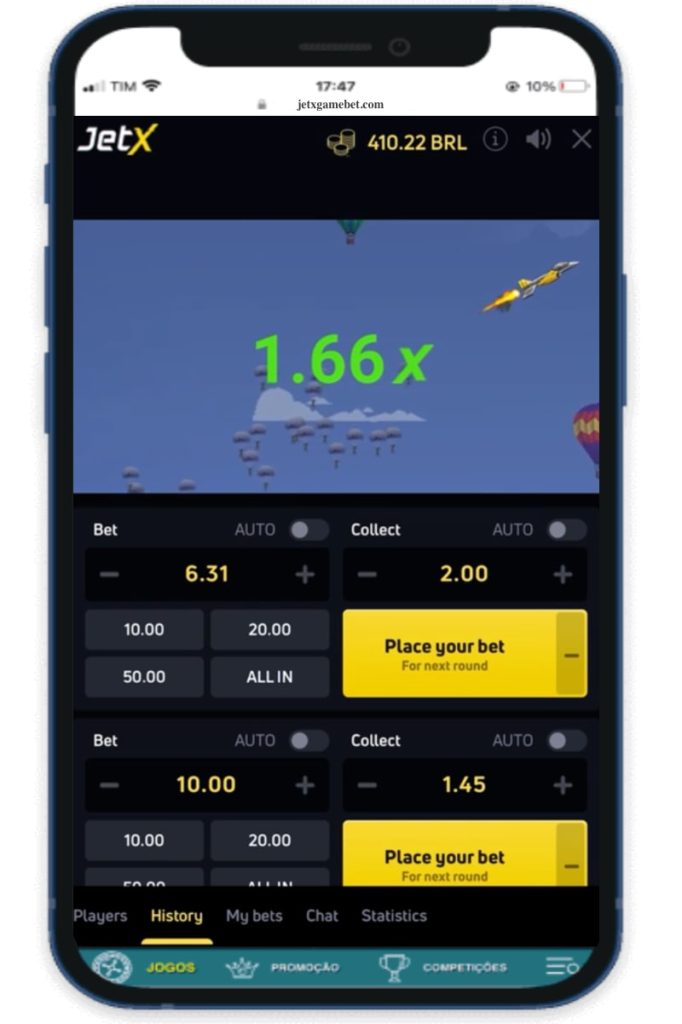

O JetX é um jogo de cassino online desenvolvido pela SmartSoft, que conquistou muitos jogadores no Brasil por sua dinâmica divertida e potencial de ganhos. Neste artigo, vamos falar sobre onde encontrar bonus codes para JetX e a forma correta de usá-los para maximizar seus bônus e aumentar suas chances no jogo.

Um bonus code (código de bônus) é uma sequência de letras ou números que jogadores podem inserir em sites de cassino para receber vantagens, como rodadas grátis, bônus em depósito ou crédito extra para jogar JetX. Eles são disponibilizados por cassinos online como forma de atrair ou premiar os jogadores.

O JetX possui uma interface moderna, intuitiva e otimizada para dispositivos móveis. É simples entender suas regras: o jogador aposta antes de o jato decolar, buscando retirar o valor multiplicado antes que ele voe para longe. A sensação de tensão e a possibilidade de multiplicações elevadas fazem o JetX ser viciante e emocionante.

A popularidade crescente do JetX entre os brasileiros deve-se à combinação de simplicidade, rapidez e a ideia diferente dos jogos tradicionais de caça-níqueis e roletas. A possibilidade de controlar o momento de retirada aliada a gráficos rápidos e navegação fluida torna o jogo apelativo principalmente para jogadores que gostam de riscos calculados e adrenalina.

Além disso, a disseminação dos bonus codes facilita a entrada de novos jogadores, que podem começar a jogar com vantagens e maior saldo inicial, atraindo assim ainda mais público para esse título da SmartSoft.

Sim, muitos cassinos online oferecem um modo demo do JetX, permitindo experimentar o jogo com créditos virtuais antes de apostar dinheiro real.

Não é obrigatório, mas o uso do código pode proporcionar bônus extras, aumentando seu saldo e as chances de ganhos.

Verifique sempre as condições da oferta no site do cassino ou das plataformas confiáveis brasileiras de bônus, pois alguns códigos têm restrições regionais ou de tempo.

Assim como qualquer aposta, use os bônus com responsabilidade. Leia os termos para entender requisitos de apostas e restrições, evitando surpresas.

| Casino Online | Presença do JetX | Ofertas de Bonus Code | Métodos de Pagamento | Suporte ao Jogador |

|---|---|---|---|---|

| Betsson | Sim | Bônus para novos jogadores + códigos promo periódicos | Boleto, Pix, cartões | Chat 24h |

| 22Bet | Sim | Códigos exclusivos para JetX | Pix, transferências, criptomoedas | Chat e email |

| Spin Casino | Sim | Bônus combinados com códigos de depósito | Cartões, e-wallets | Chat ao vivo 24h |

Lucas M;, Recife, PE: "Comecei a jogar JetX com um código de bônus que peguei em um site confiável. O bônus me deu saldo extra para explorar a dinâmica do jogo e após algumas rodadas consegui retirar um bom lucro. Recomendo para quem quer entrar no JetX com mais segurança e capital inicial."

Em resumo, o uso de bonus codes para JetX é uma ótima forma de impulsionar sua experiência, dando mais oportunidades e tempo para aprender a dinâmica do jogo que se tornou um favorito dos jogadores brasileiros de cassino online.

Read morePara los aficionados de los casinos en línea en México, Balloon App desarrollada por SmartSoft llega como una opción innovadora y divertida. Este juego de casino, que gira en torno a explosiones de globos con premios, ha capturado la atención por su sencillez, gráficos atractivos y potenciales ganancias. A continuación, descubre todo lo que necesitas saber para disfrutar de Balloon App desde tu dispositivo móvil o computadora.

Balloon App es un juego de casino online que combina elementos de casual gaming con apuestas, desarrollado por el reconocido proveedor SmartSoft. Su mecánica se basa en inflar globos sin que exploten para acumular premios crecientes, brindando una experiencia rápida, emocionante y sencilla.

El diseño es colorido y cuidado, ideal para atraer a jugadores de todas las edades. La interfaz es intuitiva, con botones claros para inflar, cobrar o seguir intentando. Los tiempos de carga son mínimos, lo que garantiza sesiones fluidas.

La dinámica es simple pero cargada de tensión, perfecta para jugadores que buscan una mezcla de estrategia y azar.

Existen varios casinos en línea que ofrecen juegos de SmartSoft y están accesibles desde México, como:

Estos casinos cuentan con licencia y métodos de pago confiables, asegurando un entorno seguro para probar Balloon App.

| Característica | Descripción |

|---|---|

| Gráficos | Colores vivos, animaciones fluidas y un diseño amigable. |

| Interacción | Modo de un jugador con decisiones instantáneas y volatilidad media. |

| Compatibilidad | Disponible en móviles iOS, Android y navegadores de escritorio. |

| Bonificaciones | Premios acumulativos por cada inflado exitoso, con opción a cobrar en cualquier momento. |

| Accesibilidad | Juega sin descarga desde cualquier dispositivo con internet. |

“Balloon App me enganchó por su simplicidad y velocidad. Es ideal para sesiones rápidas y el diseño evita la fatiga visual. Además, la volatilidad me permite controlar el riesgo y disfrutar durante horas.”

“Hemos visto un aumento en la interacción de jugadores mexicanos con Balloon App. La integración con nuestras plataformas fue sencilla y aporta variedad a los catálogos, lo que mejora la retención de usuarios.”

En definitiva, Balloon App presenta un formato fresco dentro del mercado de juegos de casino online en México. Su accesibilidad, interfaz dinámica y la emoción al manejar riesgos lo convierten en una propuesta atractiva para jugadores nuevos y veteranos. Recomendamos experimentar primero en modo demo y luego disfrutar con prudencia en apuestas reales desde casinos confiables.

Read moreWhoa! Ever noticed how some prediction markets just nail the timing on event resolutions and others lag behind, leaving traders hanging? That delay or clarity around event outcomes can seriously mess with your trading game, especially in crypto-based sports predictions. I’ve been poking around this space for a bit, and it’s wild how much the nuances of event resolution impact trading volume and, ultimately, your gains or losses.

Okay, so check this out—event resolution isn’t just about declaring a winner or loser; it’s the heartbeat of prediction markets. If you think of sports betting on blockchain platforms, the speed and accuracy of resolving bets directly influence trader confidence. When events resolve promptly, trading volumes spike because folks know the system works. But if there’s ambiguity or delays? Man, the market dries up like a drought-hit creek.

Initially, I thought all platforms would have similar event resolution mechanisms, but then I realized the devil’s really in the details. For example, some markets rely on oracles that update outcomes automatically, while others depend on community consensus or admin intervention. On one hand, automated oracles promise speed and impartiality, though actually they sometimes get tripped up by data inconsistencies or downtime. On the other hand, human-based resolutions can be slower but might catch edge cases better.

Hmm... something felt off about how many traders overlook the importance of volume fluctuations tied to event resolution. The trading volume isn’t just a vanity metric—it’s a real-time signal for liquidity and market health. Higher volume generally means better price discovery and less slippage, which is crucial when you’re dealing with volatile crypto assets on prediction platforms.

Seriously? Yeah, because when volumes dip right before event resolution, it often signals uncertainty or distrust among traders. That’s a red flag. Conversely, a climb in volume approaching a sporting event’s outcome suggests traders are positioning for final payouts, making it a high-stakes moment in the market’s lifecycle.

Here’s what bugs me about some crypto prediction platforms: they hype up their trading volumes without clarifying how event resolutions are handled. It’s like selling a car without mentioning the engine type. For traders focused on sports predictions, transparency around event resolution protocols is very very important, yet often glossed over.

Now, I’m biased, but I’ve found that platforms integrating decentralized oracle networks tend to balance speed and trustworthiness better than those relying purely on admin calls. This is where polymarket official site comes into the picture. Their approach to event resolution, especially for sports-related markets, leverages a hybrid oracle model that minimizes bottlenecks and boosts trader confidence.

One personal experience I can share: during a major NBA playoff market, I noticed the trading volume surged dramatically a few hours before the game ended. The event resolution was swift, and payouts were almost instantaneous. That immediacy kept the market vibrant and traders engaged. Contrast that with another platform where resolution lagged by days—trading volumes tanked, and a lot of users just dropped out.

So why does this matter beyond just the immediate thrill? Well, from a systemic perspective, high trading volumes around event resolution periods improve market efficiency. Prices become more reflective of collective wisdom, which benefits all participants. But here’s the catch—if resolution processes are opaque or delayed, it introduces friction that skews pricing and deters serious traders.

Of course, no system is perfect. Sometimes oracles face outages, or unexpected controversies arise over sports results (like fouls or reviews). On those occasions, markets might pause or face disputes—a messy but unavoidable reality. That said, platforms that prepare for these hiccups with backup resolution mechanisms tend to retain user trust better.

Something else worth mentioning: trading volume patterns can also hint at insider activity or market manipulation, especially in less liquid sports markets. If you see sudden spikes without clear news, it’s a cue to dig deeper. This is why transparency in how event outcomes are verified and announced is crucial for fair play.

Interestingly, as crypto prediction markets mature, they’re borrowing from traditional financial market practices to handle these issues. Things like escrow smart contracts and multi-source oracle feeds help reduce the risk of resolution errors and volume manipulation. It’s a fascinating blend of old-school finance logic and cutting-edge blockchain tech.

One last thought—if you’re hunting for a reliable platform to trade sports event predictions with crypto, don’t just chase the flashiest UI or the biggest jackpots. Look closely at how they manage event resolution and how that impacts trading volume. A lively, transparent market around event outcomes usually means better odds for you to capitalize on your insights.

Okay, I’ll admit it—I'm a fan of platforms that get these details right. The polymarket official site does a solid job here. Their event resolution system is clear and relies on decentralized data inputs, which helps keep the trading volume robust and fluid. Plus, payouts happen quickly post-resolution, which keeps traders coming back.

Their sports markets tend to attract serious traders because the environment feels fair and the liquidity is decent, not just hype. I’ve noticed that around big games, volumes can double or triple compared to usual days, reflecting genuine excitement and confidence in the platform’s mechanisms. That kind of momentum can’t be faked.

What’s cool is that Polymarket also offers a variety of trade types and flexible settlement windows, letting traders position themselves not just on final outcomes but also on intermediate events. This complexity adds depth to volume patterns, making the markets more dynamic and interesting.

Though I’m not 100% sure how they handle every edge case, their transparency around event resolution and volume stats is a breath of fresh air compared to some opaque competitors. If you want to test the waters of crypto-driven sports predictions, their platform is definitely worth a look.

Anyway, I could ramble on about this stuff, but here’s the takeaway: the intersection of event resolution speed and trading volume is where prediction markets live or die. Pay attention to those signals, and you’ll avoid a lot of frustration and missed opportunities. Oh, and by the way, don’t underestimate how a well-oiled resolution process can turn a so-so market into a buzzing hive of activity.

Delays create uncertainty, causing traders to hesitate or pull out, which reduces market liquidity and volume. Quick, reliable resolutions boost trader confidence and increase volume.

Higher volume usually means better liquidity, tighter spreads, and more accurate price discovery, making it easier to enter and exit positions without heavy slippage.

They use decentralized oracle networks combined with transparent protocols, reducing single points of failure and ensuring timely, trustworthy event outcomes.

Whoa! The first time I traded an event contract I felt a weird mix of thrill and nuisance. My instinct said this was something big—something that could capture collective wisdom quickly. But at the same time I kept thinking: what are we actually pricing? Risk? Information? Hype? That tension stuck with me.

Here's the thing. Event contracts strip a prediction down to a binary bet and let a market decide a probability. They are simple on the surface, but messy under the hood. You get crisp odds. You also get the noise of news cycles, liquidity quirks, and speculators who trade for reasons other than truth discovery. It's messy in a productive way, though—that is, when the market has depth and good incentives.

Short version: they work when incentives align. Long version: the design details matter a lot, from fee structure to how outcomes are verified, and those small design choices change trader behavior, which in turn changes the signal you get from prices.

When I first studied Polymarket-style markets I assumed liquidity was the bottleneck. Actually, wait—let me rephrase that. Liquidity matters, but the bigger issues are information flow and participant incentives. On one hand, shallow markets are noisy. On the other hand, some depth with perverse incentives just amplifies the wrong signals. So it's not linear.

Okay, so check this out—an event contract turns a question into a tradeable asset. Want to know if candidate X will win? Buy a "yes" contract. Price moves as people buy and sell. That price can be read as the market's collective probability. Pretty neat, right? But there are caveats.

My gut reaction to many markets was: this is too simplistic. Really? You think a single price can capture all nuance? At first I thought the market would always converge to the truth. Then I watched a handful of markets that converged to the wrong narrative because a news outlet misinterpreted a court filing. Oof.

So what happened? Traders reacted to what looked like new information, and the market updated. Later, when the story corrected, some traders moved in, but not enough to fully reverse the mispricing. That told me something about the composition of participants: quick-reactors and hold-for-the-mean traders behave differently, and you need both types to keep prices honest.

Also, fees and settlement mechanics matter. If fees are too high, arbitrageurs (the folks who will fix temporary mispricings) get discouraged. If settlement rules are ambiguous, traders hedge less and the market becomes a popularity contest. Small rules, big effects. I'm biased, but governance and clear arbitration have always been the part that bugs me most.

There are design levers. For prediction markets to be useful: liquidity, clear settlement, low enough friction for arbitrage, and a diverse participant base. Achieve that and you get surprisingly reliable signals.

But honestly, some signals are better than others. Not every question deserves a market. Some are too vague, and others are too easily manipulated by small groups with aligned incentives. That part is tricky, and it's where practical experience beats theory.

Let me give you a practical mental checklist I use when evaluating a market's quality: clarity of the proposition, settlement clarity, expected liquidity, fee structure, and the news cycle sensitivity. If two or three of these fail, treat the price with caution. If four or five are solid, you can start leaning on the market as a real-time gauge.

Mostly yes, but context matters. In deep, well-trafficked markets prices correlate strongly with real-world probabilities. In shallow or news-driven markets they can be volatile and biased. My instinct is to trust broad trends rather than single ticks. Also, consider the incentives of major participants—if a whale is trading for a hedge rather than information, the reading is different.

Huge role. If the outcome adjudication is murky, the market becomes less useful. Clear, fast settlement reduces ambiguity and encourages traders to correct mispricings. When outcomes hinge on subjective interpretation, expect drawn-out disputes and less reliable prices. (Oh, and by the way—platform reputation is part of that arbitration credibility.)

One thing folks under-appreciate is how much market microstructure shapes behavior. For example, on some platforms shorting is easy and cheap. On others it's effectively constrained. That changes who participates and what strategies make money. Initially I thought volume was the best proxy for quality. Later I realized turnover composition — who's trading and why — matters more.

Something felt off about markets that look active but are dominated by churn from the same accounts. You see lots of volume, but the price doesn't incorporate fresh information. That kind of activity can create false confidence—very very important to watch out for.

On the policy and governance side there are interesting trade-offs. Centralized arbitration speeds things up but concentrates trust. Decentralized approaches distribute trust but can be slower and more contentious. On one hand you want immutable rules; on the other, rigid rules sometimes fail to cover edge cases. Though actually, that's where governance agility helps—if the community can iterate responsibly, the market improves over time.

I'm not 100% sure about the best governance model. My working hypothesis is a hybrid: clear, objective settlement for the normal cases, with an on-chain governance path for the weird edge cases. That keeps the day-to-day functioning solid while allowing human judgment when ambiguity arises.

Polymarket and similar platforms have been experimenting in that space. If you want to poke around and see how these mechanics look in the wild, check this out: https://sites.google.com/polymarket.icu/polymarketofficialsitelogin/ — I used it as a reference when mapping settlement paths (and yes, some of these docs are messy, which is telling in itself).

There are deeper implications too. Prediction markets change how we aggregate dispersed knowledge. In a world where attention is fragmented, markets compress signals into a digestible number. They don't replace analysis; they augment it. Use prices as inputs, not as gospel.

I'll end with a practical note for new users: start small, watch how prices react to verified information, and learn the rhythm of a market before you trade big. Also, don't confuse volatility with truth. Markets can be loud. Listen, but don't get swept up.

Read moreWhoa!

I was noodling on governance last week and hit a small panic moment. Seriously? The system that’s supposed to decentralize power often concentrates it instead. My instinct said somethin' was off when token-weighted votes kept bending to the largest LPs, and that feeling stuck with me. Initially I thought token locks like veCRV-style models fixed incentives, but then realized that voting power, bribe markets, and cross-chain liquidity all conspire to blur accountability in ways that are not obvious until they bite hard.

Hmm... okay, so check this out—

DeFi governance looks clean on paper: proposals, on-chain voting, execution. But in practice there’s a thousand tiny frictions — governance timelocks, multisigs, snapshot voting quirks. On one hand these friction points are safety valves; on the other, they create opacity and gateways for influence to hide behind pseudo-decentralized veneers. Actually, wait—let me rephrase that: some protocols have become highly resistant to quick change, which is good for security, though actually bad when rapid coordination is needed across chains and bridges.

Whoa!

Cross-chain swaps are the obvious frontier for liquidity efficiency. They promise that a stablecoin on one chain can be used seamlessly on another, reducing fragmentation and slippage. But the reality today is more like a patchwork of bridges, relayers, and liquidity pools that each add subtle costs and trust assumptions. Something felt off about quoting a "one-click swap" only to find hidden bridges and liquidity hops, and that bugged me; the UX hides risk from retail users. On top of that, governance teams face the pain of coordinating upgrades and incentives across multiple ecosystems — which complicates decision-making and dilutes accountability.

Whoa!

Here's the thing. DeFi protocols rely on two overlapping control levers: token incentives and code. Tokens steer behavior; smart contracts enforce it. That combo is powerful, but it creates an odd tension—voters can propose changes that the contracts don't permit without additional signatures or timelocks. So the governance path becomes political, not purely technical. On a slow, thoughtful level I can see why time-locks and multisigs are used, though sometimes they become ritual theater where real power sits off-chain.

Wow!

Practically speaking, three problems crop up for cross-chain governance:

First, liquidity fragmentation — the same stablecoin split across seven chains spreads volume thin and magnifies slippage during stress. Second, governance capture — large stakers or coordinated bribe campaigns shape proposals, meaning public goods get underfunded. Third, optimistic execution risk — bridges or relayers that are central points of failure cause governance decisions to be harder to enforce cross-chain. These three often interact, and when they do, failures cascade.

Wow!

To be fair, there are technical fixes on the horizon. Layered architectures that separate settlement and routing, better cross-chain state proofs, and atomic swap primitives can cut down the trust surface. But technology alone won't fix incentives. People follow money, and if voting rewards or bribes pay better than long-term stewardship, governance will skew toward short-term gains. I'm biased, but I think you need both technical robustness and cultural norms that penalize short-term rent-seeking.

Whoa!

Operationally, protocols should treat governance like product design. Build for latency and error. Design default fallbacks. Use staggered rollouts and safety periods that are meaningful, not symbolic. On a more analytical level, consider hybrid voting systems — mix token-weighted votes with quadratic or identity‑weighted components to reduce outsized influence. On the other hand, implementing identity layers invites privacy trade-offs and sybil risks, so no single approach is a silver bullet.

Whoa!

Let's talk about Curve as a case study, because it sits at the center of stablecoin swaps and gauge incentives in the DeFi tapestry. I use Curve a lot for low-slippage stablecoin trades. That said, governance here shows both strengths and weaknesses. The ve‑model helps align long-term LPs with protocol health, and gauge voting directs emissions to efficient pools. But when cross-chain bridging enters the picture, the governance calculus shifts — should the protocol favor liquidity on Chain A or Chain B? Who pays the bridge fees? Where does the safety margin come from? Those are political questions as much as engineering ones.

If you're building or voting, think in terms of cheap wins and hard trade-offs. Cheap wins include clearer on-chain documentation, standardized cross-chain failure modes, and simple signals for emergency action. Hard trade-offs include disincentivizing short-term bribery without throttling legitimate governance participation. For a quick reference on how some leading pools structure gauge voting and ve-style incentives, check the curve finance official site — it's a useful baseline for how protocol design shapes incentive flows across chains.

Whoa!

Here are three tactical changes I'd push for across DeFi projects:

1) Cross-chain governance observability: publish an on-chain map of where liquidity is and which bridges are used, updated frequently. 2) Dynamic timelocks: allow staggered but reversible changes that can be fast in emergencies yet slow for noncritical upgrades. 3) Bribe transparency: require standardized reporting for third-party incentive flows, with penalization for undisclosed off-chain deals. None of these are perfect, though they move the needle toward accountability.

Whoa!

On a human note, governance is less about code and more about people. Voter education, accessible dashboards, and community moderation matter. When token holders are opaque or inactive, power concentrates quietly. When smart money coordinates, they do it swiftly and often invisibly. I like watching governance forums because they reveal hidden incentives — and sometimes those forums are messy and wonderful at once, with real debate and also theatre.

Wow!

There will be pushback. Some will argue that stronger safeguards slow innovation or that identity systems invite censorship. Those concerns are valid. On the other hand, ignoring coordination failures means risking catastrophic liquidity black swans during cross-chain stress events. On balance, a mix of better technical primitives and social governance design seems the least bad path forward.

Whoa!

So what should a DeFi user do right now?

First, read proposals carefully; don't assume token-weight equals good intent. Second, diversify liquidity across well-audited pools and across trusted bridges. Third, participate or delegate to delegates you actually trust, not to influencers who echo short-term gains. I'm not 100% sure these will prevent every failure, but they're practical and reduce exposure.

Locking aligns long-term liquidity provision with governance power, which can reduce churn and reward patient capital. However, it also concentrates influence in large lockers and can amplify bribe markets, so protocols must balance lock durations, boost mechanics, and anti‑bribery transparency measures.

They can be efficient, but safety depends on the bridges and relayers involved. Atomic swap primitives and audited routing reduce risk, while unvetted bridges or centralized relayers add single points of failure. Always check the source of liquidity and understand the recovery plan for each bridge.

Whoa, this caught my eye. I keep coming back to hardware security as a practical obsession. Users who prioritize privacy should never treat backups casually. Initially I thought the standard 12-word seed was sufficient, but then real-world incidents and careful reading of threat models showed me that there are many subtle failure modes that most guides omit or downplay.

Okay, so check this out—shortcuts are everywhere. My instinct said that writing the seed on paper was fine, until I saw a flood-damaged safe deposit box in a story and felt uneasy. On one hand paper is simple; on the other hand the chance of physical loss or theft is nontrivial. Honestly, I'm biased, but metal backups reduce the "oops" factor in a way that paper rarely does. Something felt off about the DIY methods people share online without context.

Seriously? Yes, seriously. Threat modeling matters more than checklisting. If an attacker can coerce you, or break into your home, or find your seed written on paper, they are in. So the question becomes: what backup architecture survives multiple simultaneous failures? The short answer is layered defenses, not a single golden backup that fails catastrophically.

Here's the thing. You can split risk across multiple storage modes—physical, geographical, and cryptographic. Use a robust metal plate for fire and water resistance, store copies in different jurisdictions if practical, and consider a passphrase as an additional layer that turns a single seed into many possible accounts. I'm not 100% sure every reader needs a passphrase, but most privacy-focused users should at least consider it. Initially I thought passphrases were overkill; actually, wait—let me rephrase that: for small amounts they may be unnecessary, though for anything you can't afford to lose they add a powerful layer of plausible deniability.

Hmm... a little sidebar here. Your threat model changes everything. If you worry about remote malware, then an offline air-gapped signer should be high on your list. If physical theft is the concern, then split-storage and passphrases matter more. On the flipside, if you often need quick access, a complicated multi-location backup could be impractical and dangerous in an emergency. So deciding how resilient your backup must be is first order work.

Short and sharp: never type your seed into a phone or browser. That rule is simple and it bites people who treat convenience as the highest priority. Air-gapped operations—using an isolated computer or a dedicated offline device—are slightly more cumbersome, yes, but they cut a huge class of remote attacks. Practically speaking, an air-gapped workflow plus a hardware signer is a good baseline for serious users. Remember that convenience is the enemy of security when money is at stake.

Wow, a common misstep: trusting cloud backups. Lots of folks back up images or notes to the cloud and forget that these services get compromised or subpoenaed. On one hand cloud storage gives redundancy and ease; on the other hand it centralizes risk. I'm biased against putting unencrypted seeds online, even temporarily, because the tradeoffs are rarely worth it. So keep seeds off-line, encrypted if you must store them digitally, and ideally not stored digitally at all.

Longer thought about passphrases: they are like adding a password to your wallet's seed, and they can give you plausible deniability if used cleverly. Use a strong but memorable passphrase and keep it secret from others in your circle—never write it on the same sheet as the seed. Some people treat passphrases as the magic cure, though actually passphrases are only as strong as your memory and your secrecy practices. On the technical side, a passphrase effectively creates a different wallet from the same seed, which can help if your device is compromised but the passphrase remains secret and uncompromised.

Okay, let's talk recovery scenarios. If a device is lost, the recovery process requires the seed (and passphrase, if used) to rebuild access. Have a tested plan for recovery that doesn't rely on remembering vague hints or expecting a single friend to always be available. Practice a dry-run recovery using expendable test wallets before you rely on it for real funds. I'll be honest: many people never test recovery until they urgently need it, and that usually goes poorly. So the best backup is one you can actually recover from under stress.

Check this out—firmware and software updates matter too. Trezor devices rely on signed firmware and the accompanying desktop or web apps to interact with them. Running outdated firmware can expose you to old bugs, while rushing to update without verifying the source can be risky if you don't use official channels. The safest path is to update via the official app and verify firmware signatures when prompted. Use caution with community forks or third-party integrations unless you fully understand the tradeoffs.

Image break—check this out for emphasis.

Tor isn't a silver bullet, but it helps reduce metadata leaks about when and how you use crypto. Using Tor can obscure network-level information that links your device or wallet to your IP address, which matters for users who want privacy beyond just on-chain anonymity. Trezor's desktop Suite and certain integrations can be configured to route traffic through Tor or a SOCKS proxy, though you should check the app settings and documentation to confirm; for convenient reference see trezor suite. Be cautious: routing everything through Tor can interact oddly with some network features, and it does not protect against endpoint or device compromise. So think of Tor as one tool among many in a layered approach.

Initially I thought Tor would slow me down unacceptably, but in practice the latency is manageable for routine wallet operations. If you are doing heavy transactions often, then yes, the lag adds up and can be annoying. Still, for occasional use or privacy-conscious sessions it feels fine. On the other hand, Tor doesn't stop physical surveillance or coercion, so pair it with strong local security measures. Also, keep in mind that Tor exit nodes can see unencrypted traffic, so always use end-to-end encrypted APIs when possible.

Here's what bugs me about one-size-fits-all guides. They often skip the part where user behavior undermines theoretical security—passwords written on sticky notes, seeds tucked into a drawer labeled "wallet". People are human, and humans take mental shortcuts. So design backups that assume human error and minimize catastrophic failure modes even when someone is tired or distracted. That means redundancies, checks, and clear recovery instructions stored separately from seeds (but not near them).

On the topic of splitting seeds: there are cryptographic schemes like Shamir's Secret Sharing that create multiple shares, and there are manual methods like splitting a seed phrase across locations. Both approaches have pros and cons. Cryptographic splitting can be elegant and precise but requires careful implementation and compatible tools. Manual splitting is low-tech and sometimes more robust socially (you can leave shares with trusted institutions), though it's also prone to correlation risk if not diversified. On balance, choose a method that matches your technical comfort and threat model.

Short note about device provenance: buy hardware wallets from official vendors or trusted resellers only. Unopened boxes bought from sketchy auctions or from unknown sellers can carry risks of tampering. If you buy used, perform a full factory reset and verify firmware signatures during setup; better yet, avoid used devices for significant funds unless you can thoroughly verify provenance. I'm not being alarmist—this is just practical risk mitigation.

Some real-world habits worth adopting: label recovery instructions clearly, keep emergency contacts, and create a legal plan for inheritance. A good estate plan for crypto includes clear instructions and redundancies but avoids exposing seeds to too many people. One effective compromise is to instruct a lawyer or trusted custodian on how to recover funds without revealing the seed itself, using multi-step protocols. I'm not an attorney, and you should get legal counsel for estate planning; somethin' like this varies by state and family situation.

Short answer: no. A passphrase complements a seed but does not replace the physical seed itself. If you lose both the seed and the passphrase, you lose access permanently. Use passphrases as an extra security/privacy layer and keep physical backups nonetheless.

Generally yes for privacy-minded users, but be mindful of latency and compatibility. Tor reduces network-level metadata but doesn't protect a compromised device, and some services might flag Tor traffic. Test your workflow and understand the tradeoffs before relying on Tor exclusively.

Shamir and manual splitting are both viable for increasing resilience, but they increase operational complexity. If you choose splitting, document your recovery procedures and test them. If you prefer simplicity, multiple geographically separated metal backups plus a passphrase may suit you better.

L’univers des casinos en ligne regorge de surprises, mais peu de plateformes parviennent à captiver les joueurs avec autant de charme que Betzino. Lancé en 2021, ce casino en ligne s’est rapidement imposé comme une destination prisée pour les amateurs de jeux d’argent en quête d’une expérience immersive et divertissante. Avec son design élégant, sa ludothèque variée et ses promotions alléchantes, Betzino offre un voyage ludique où chaque partie est une aventure. Cet article vous emmène à la découverte de ce casino en ligne, de ses fonctionnalités uniques et des raisons pour lesquelles il séduit tant de joueurs francophones.

Dès l’ouverture de la plateforme, Betzino séduit par son esthétique soignée. Les couleurs vibrantes, mêlées de nuances de bleu et de violet, créent une atmosphère envoûtante, comme une invitation à explorer un monde féerique. Le design n’est pas seulement esthétique : il est également fonctionnel. La navigation est fluide, avec un menu clair qui permet d’accéder rapidement aux différentes sections, qu’il s’agisse des jeux, des promotions ou du programme VIP. Que vous soyez un joueur novice ou expérimenté, l’interface intuitive garantit une prise en main immédiate, même pour ceux qui découvrent le casino en ligne pour la première fois.

La compatibilité mobile est un autre atout majeur. Sans nécessiter de téléchargement d’application, Betzino s’adapte parfaitement aux smartphones et tablettes, qu’ils fonctionnent sous iOS ou Android. Les jeux se chargent rapidement, et l’expérience reste tout aussi immersive sur un petit écran que sur un ordinateur. Cette flexibilité permet aux joueurs de profiter de leurs titres préférés où qu’ils soient, que ce soit dans les transports ou confortablement installés chez eux.

Le cœur de l’expérience Betzino réside dans sa ludothèque, qui compte plus de 2 000 jeux soigneusement sélectionnés pour satisfaire tous les goûts. Les amateurs de machines à sous seront comblés par une sélection impressionnante, allant des classiques à trois rouleaux aux slots modernes dotés de graphismes époustouflants et de fonctionnalités innovantes. Des titres populaires comme Sweet Bonanza ou Gates of Olympus offrent des sessions dynamiques avec des possibilités de gains excitantes.

Les jeux de table occupent également une place de choix. Que vous préfériez le suspense du blackjack, la stratégie du poker ou l’élégance de la roulette, Betzino propose de nombreuses variantes pour renouveler l’expérience. Pour ceux qui recherchent une immersion totale, le casino en direct est un véritable joyau. Animé par des croupiers professionnels, il permet de jouer en temps réel à des jeux comme le baccarat ou la roulette, recréant l’ambiance d’un casino physique depuis le confort de votre salon.

Enfin, Betzino innove avec des jeux télévisés interactifs, comme Crazy Time, qui mêlent divertissement et opportunités de gains. Ces titres, développés par des fournisseurs de renom tels que Pragmatic Play, NetEnt ou Evolution Gaming, garantissent une qualité irréprochable et des sessions captivantes.

Betzino sait comment choyer ses joueurs grâce à une politique de bonus particulièrement attractive. Dès l’inscription, les nouveaux venus sont accueillis par un généreux bonus de bienvenue, réparti sur plusieurs dépôts. Ce package inclut des fonds supplémentaires et des tours gratuits, permettant de découvrir les machines à sous les plus populaires sans prendre de risques. Les conditions de mise, clairement expliquées, restent accessibles, offrant une réelle chance de transformer ces bonus en gains réels.

Mais l’aventure ne s’arrête pas là. Betzino propose des promotions régulières pour maintenir l’excitation. Parmi elles, on retrouve :

Happy Hour : Chaque mercredi, les joueurs peuvent bénéficier d’un bonus sur leurs dépôts effectués à des heures précises, idéal pour booster leur session de jeu.

Bonus du vendredi : Une offre spéciale pour bien commencer le week-end, avec un pourcentage supplémentaire sur les dépôts.

Week-end Bonus : Une promotion qui récompense les joueurs avec des fonds additionnels pour leurs parties du samedi et du dimanche.

Défis Live Casino : Des challenges sur les jeux en direct, offrant des récompenses pour les mises effectuées sur des titres spécifiques.

Ces offres, combinées à des promotions saisonnières, garantissent que chaque visite sur Betzino réserve son lot de surprises.

Pour les joueurs les plus fidèles, Betzino propose un programme VIP exclusif, surnommé le Cercle Magique. Ce club prestigieux récompense l’engagement des joueurs avec des avantages sur mesure. Les membres VIP bénéficient d’un gestionnaire de compte dédié, d’offres personnalisées et de limites de retrait plus élevées. Les cashbacks hebdomadaires, disponibles uniquement pour les VIP, permettent de récupérer une partie des mises, ajoutant une couche de confort à l’expérience de jeu.

Rejoindre le Cercle Magique n’est pas automatique : l’équipe de Betzino évalue l’activité des joueurs pour proposer une invitation. Une fois membre, chaque session devient encore plus gratifiante, avec des cadeaux exclusifs et un service client prioritaire.

La sécurité est au cœur de l’expérience Betzino. La plateforme, licenciée par les autorités de Curaçao, utilise un cryptage SSL de pointe pour protéger les données personnelles et financières des joueurs. Les transactions, qu’il s’agisse de dépôts ou de retraits, sont rapides et sécurisées, avec un large choix de méthodes de paiement, incluant les cartes bancaires, les portefeuilles électroniques et les cryptomonnaies comme le Bitcoin ou l’Ethereum.

L’inscription est un jeu d’enfant.Treasure trove, ne prenant que quelques minutes. Les joueurs doivent simplement fournir une adresse e-mail, un mot de passe et confirmer leur majorité. Une fois le compte créé, ils peuvent immédiatement commencer à jouer et profiter des bonus.

Le service client, disponible via chat en direct ou e-mail, est réactif et multilingue, garantissant une assistance rapide en cas de besoin. De plus, Betzino encourage le jeu responsable en proposant des outils comme des limites de dépôt ou des pauses temporaires, pour une expérience sûre et maîtrisée.

Betzino se distingue par son équilibre parfait entre divertissement, générosité et fiabilité. Que vous soyez passionné de machines à sous, de jeux de table ou de casino en direct, la plateforme offre une variété de choix impressionnante. Son design soigné, ses promotions régulières et son programme VIP en font un choix incontournable pour les amateurs de casino en ligne. Chaque clic sur Betzino promet une nouvelle dose d’excitation, dans un environnement sécurisé et accueillant.

Read moreLe monde du jeu en ligne est un espace où l’excitation rencontre l’innovation, et DublinBet se distingue comme une plateforme qui capture parfaitement cette alchimie. Avec une offre de jeux variée, une interface intuitive et des promotions qui dynamisent chaque session, DublinBet offre une expérience de casino virtuel à la fois captivante et accessible. Cette plateforme invite les joueurs à explorer un univers de divertissement où chaque partie est une nouvelle aventure. Dans cet article, nous mettons en lumière les éléments qui font de DublinBet une destination de choix pour les amateurs de jeu en ligne.

En accédant au site officiel dublinbets.fr, les joueurs découvrent une interface qui allie élégance et praticité. Le design de DublinBet se caractérise par des couleurs riches et une mise en page soignée, évoquant l’ambiance feutrée d’un casino traditionnel tout en restant résolument moderne. Les menus, clairs et bien organisés, permettent de naviguer sans effort entre les différentes sections, qu’il s’agisse des jeux, des promotions ou des options personnalisées.

La plateforme est conçue pour offrir une expérience fluide sur tous les appareils, qu’il s’agisse d’un ordinateur, d’une tablette ou d’un smartphone. Grâce à une technologie responsive, DublinBet garantit des performances optimales, avec des graphismes nets et des temps de chargement réduits. Cette adaptabilité permet aux joueurs de profiter de leurs sessions où qu’ils soient, avec une facilité d’accès qui rend chaque moment de jeu agréable et sans contrainte.

DublinBet brille par la diversité de son catalogue de jeux, pensé pour répondre aux attentes des joueurs les plus variés. La plateforme propose une gamme impressionnante de titres, allant des machines à sous aux jeux de table classiques, en passant par des sessions live qui recréent l’atmosphère d’un casino réel. Les machines à sous occupent une place de choix, avec des thèmes allant des récits épiques aux univers futuristes, enrichis par des animations fluides et des fonctionnalités bonus engageantes.

Pour ceux qui préfèrent les jeux stratégiques, DublinBet offre une sélection de jeux de table, incluant roulette, blackjack et baccarat, déclinés en plusieurs variantes pour renouveler l’expérience. La section live, quant à elle, transporte les joueurs dans une ambiance immersive grâce à des croupiers professionnels et un streaming en haute définition, offrant une interaction en temps réel qui ajoute une touche d’authenticité.

Voici un aperçu des principales catégories de jeux disponibles :

|

Catégorie |

Points Forts |

|---|---|

|

Machines à Sous |

Thèmes variés, graphismes immersifs, bonus dynamiques |

|

Jeux de Table |

Roulette, blackjack, baccarat avec variantes modernes |

|

Casino Live |

Croupiers en direct, streaming haute qualité |

|

Jeux Instantanés |

Titres rapides pour des sessions express |

Cette richesse d’options garantit que chaque joueur trouve une expérience adaptée à ses envies, qu’il s’agisse de parties rapides ou de sessions plus stratégiques.

DublinBet excelle dans l’art de rendre chaque session de jeu plus palpitante grâce à un système de promotions soigneusement élaboré. Les nouveaux joueurs sont accueillis par une offre de bienvenue attrayante, combinant un bonus sur dépôt et des tours gratuits, idéaux pour explorer les nombreuses machines à sous. Ces promotions sont présentées avec des conditions claires, permettant aux joueurs de maximiser leur valeur sans complications.

Pour les joueurs réguliers, la plateforme propose des offres hebdomadaires, des tournois avec des prix attractifs et un programme de fidélité qui récompense l’engagement. Ce programme permet d’accumuler des avantages exclusifs, comme des bonus sur mesure ou des privilèges spéciaux, ajoutant une dimension supplémentaire à l’expérience de jeu. Cette approche montre l’engagement de DublinBet à offrir un divertissement qui ne se limite pas au jeu, mais qui valorise chaque moment passé sur la plateforme.

La sécurité est une priorité absolue pour DublinBet. La plateforme utilise des technologies de cryptage avancées pour protéger les informations personnelles et financières des joueurs, garantissant des transactions sécurisées à chaque étape. Les jeux sont soumis à des audits réguliers par des organismes indépendants, assurant des résultats justes et aléatoires pour une expérience de jeu équitable.

Le service client renforce cette fiabilité, avec une équipe réactive disponible pour répondre à toutes les questions. Accessible via plusieurs canaux, l’assistance est rapide et professionnelle, permettant aux joueurs de résoudre leurs demandes sans interrompre leur plaisir. Cette combinaison de sécurité et de support de qualité fait de DublinBet une plateforme digne de confiance.

DublinBet s’engage à promouvoir un jeu responsable, offrant des outils pour aider les joueurs à gérer leur temps et leur budget. Des options comme les limites de dépôt, les pauses temporaires ou la gestion des sessions permettent de maintenir un équilibre entre plaisir et contrôle. Cet engagement reflète la volonté de la plateforme de créer un environnement où le divertissement reste une expérience positive et maîtrisée.